Allowances & Deductions

Best Allowances and feature Deductions In Pakistan

Connect HRMS can solve your allowances and deductions clutter in a jiff. Connect HRMS will assist you to calculate the tax of employee’s gross pay. The allowance is auto calculated to the gross pay before payroll is generated.manages the funds and donations separately by incorporating the company’s formulas and policies and implementing them automatically. Any funds and their contributions are calculated in accordance to the rules and regulation of the business and also in line with the laws of the land. Records against each individual is maintained separately and can be reviewed in detail at any stage. Thus making the life of the employee and the employer easy.

Allowances & Deductions Features

Auto Tax Deductions

The Tax is deducted according to company policy and the tax slabs deducted according to government policy.

Allowance Calculations

The allowance is calculate periodically according to the ranks in Connect HRMS without the fuss of extra paper work.

Pay Time Calculations

Monthly, Weekly, Daily or Hourly Based, no matter what the payment setup is, Connect HRMS calculates it.

Over-Time Calculation

In Connect HRMS Group based overtime rules and others can be handled with ease and the in case a certain employee group is to be denied or allowed to avail overtime.

Deduction Types

Deduction types can be created in a custom way in Connect HRMS.

Policy Based Bonuses

In Connect HRMS, employee ranks are assigned specific policies, which are mapped to payroll for automatic bonus calculations.

Explore More Features

Build Your Custom HR Experience

Centralized Platform

Everything at a single place. With interactive dashboard views, employee database, self-service features, Zimyo saves costs for businesses.

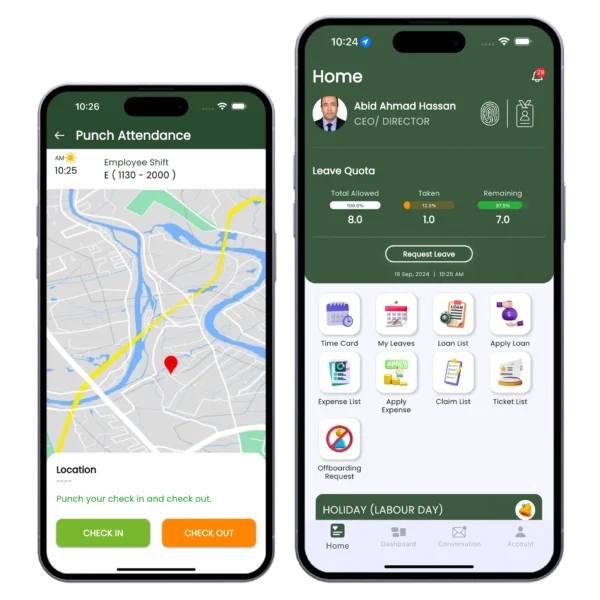

User Experience

Our intuitive HCM focuses on user experience and ensures that employees easily navigate the system and perform HR tasks.

Data Security

AI-Driven Technology

Connect HCM automates all repetitive tasks, enhances processes, and provides insights into workforce trends, all backed up by AI.

Get Free Consultation